Introduction Are slow responses and missed messages holding your business...

Read More-

Dec, Fri, 2024

EJAAS Middleware Solution Event 2024

"A Memorable Day at the

e-Jaas Middleware Solution Event 2024"

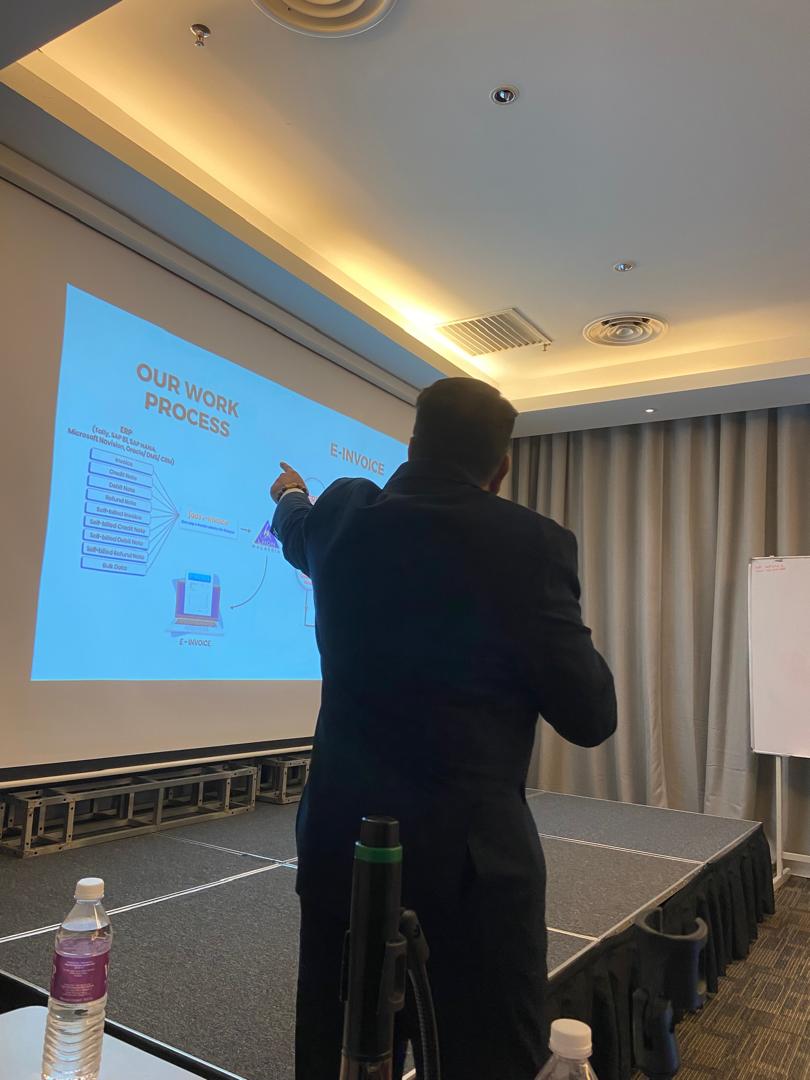

The e-Jaas Middleware Solution Event 2024 was nothing short of a remarkable experience! Held to highlight the transformative power of e-Jaas, this event brought together industry experts, professionals, and innovators under one roof to explore the possibilities of digital transformation and seamless e-invoicing compliance.

Relive The Event

Did you miss the event or want to revisit the highlights? Check out the vibrant photos from the day that captured the energy and excitement of our attendees and speakers.

Event Highlights

The e-Jaas Middleware Solution Event 2024 was a success, offering key insights, live demos, and valuable networking.

Engaging Discussions

Experts shared actionable insights on simplifying compliance and improving efficiency.

Live Demonstration

A short description of the service and how the visitor will benefit from it.

Interactive Q&A

Attendees gained clarity on adapting to Malaysia’s e-invoicing mandates.

Networking Opportunities

Professionals connected, shared ideas, and explored future collaborations.

Special Acknowledgement

Our dedicated attendees who contributed their valuable time and perspectives.

Sigma Info Analytics for their unwavering support and partnership.

Presenter for giving enlightening overview of e-invoicing regulations and compliance guidelines.

Event Feedbacks

What’s Next?

Your Transformation Awaits!

💡 Ready to elevate your business operations and customer experience?

Whether it’s adopting the latest tools or staying ahead of the competition, now is the time to take the next step.

EJAAS Middleware Solution Event 2024

“A Memorable Day at the e-Jaas Middleware Solution Event 2024″...

Read MoreA Comprehensive Guide to E-Invoicing for E-Commerce Transactions

Introduction E-commerce transactions involve the sale or purchase of goods...

Read MoreUser Guide for Malaysian Sellers: Goods Sold or Services Rendered to Foreign Purchasers

Introduction With the introduction of e-Invoicing in Malaysia, businesses...

Read More